Structure Confidence: Dependable Trust Foundations

Wiki Article

Guarding Your Assets: Depend On Foundation Proficiency within your reaches

In today's complicated economic landscape, making certain the safety and security and growth of your possessions is vital. Trust fund structures offer as a cornerstone for protecting your riches and tradition, supplying an organized technique to property defense.Relevance of Trust Foundations

Depend on foundations play a crucial duty in establishing reliability and cultivating solid relationships in numerous expert setups. Depend on foundations offer as the cornerstone for moral decision-making and transparent interaction within organizations.

Benefits of Specialist Advice

Building on the structure of count on in expert relationships, seeking expert advice supplies important benefits for individuals and organizations alike. Expert guidance provides a wide range of expertise and experience that can aid browse intricate monetary, legal, or tactical challenges effortlessly. By leveraging the knowledge of professionals in various areas, people and companies can make educated decisions that straighten with their objectives and ambitions.One considerable benefit of specialist advice is the capability to gain access to specialized knowledge that might not be easily available or else. Specialists can provide insights and viewpoints that can cause innovative solutions and possibilities for growth. Additionally, dealing with professionals can help minimize dangers and uncertainties by giving a clear roadmap for success.

Moreover, expert advice can save time and sources by enhancing processes and staying clear of expensive blunders. trust foundations. Experts can offer individualized guidance customized to particular requirements, guaranteeing that every choice is well-informed and critical. In general, the advantages of expert advice are multifaceted, making it a useful asset in securing and taking full advantage of properties for the long-term

Ensuring Financial Safety

In the realm of monetary preparation, safeguarding a stable and prosperous future rest on calculated decision-making and sensible financial investment choices. Guaranteeing monetary safety entails a complex approach that encompasses various aspects of riches administration. One vital component is developing a varied financial investment profile customized to specific threat resistance and economic objectives. By spreading out financial investments throughout various possession courses, have a peek here such as stocks, bonds, realty, and products, the danger of considerable financial loss can be reduced.

Additionally, maintaining a reserve is necessary to secure against unexpected expenses or revenue interruptions. Professionals recommend reserving 3 to 6 months' worth of living expenditures in a fluid, easily obtainable account. This fund functions as a monetary safeguard, offering assurance throughout unstable times.

Frequently reviewing and readjusting monetary strategies in reaction to changing conditions is likewise paramount. Life occasions, market fluctuations, and legislative changes can affect financial stability, emphasizing the significance of recurring assessment and adjustment in the pursuit of lasting financial safety and security - trust foundations. By executing these strategies thoughtfully and regularly, individuals can strengthen their economic footing and work in the direction of an extra secure future

Guarding Your Possessions Efficiently

With a strong structure in location for monetary safety with diversity and emergency situation fund maintenance, the next vital step is protecting your possessions efficiently. One efficient technique is asset allotment, which involves spreading your investments throughout numerous possession classes to decrease risk.

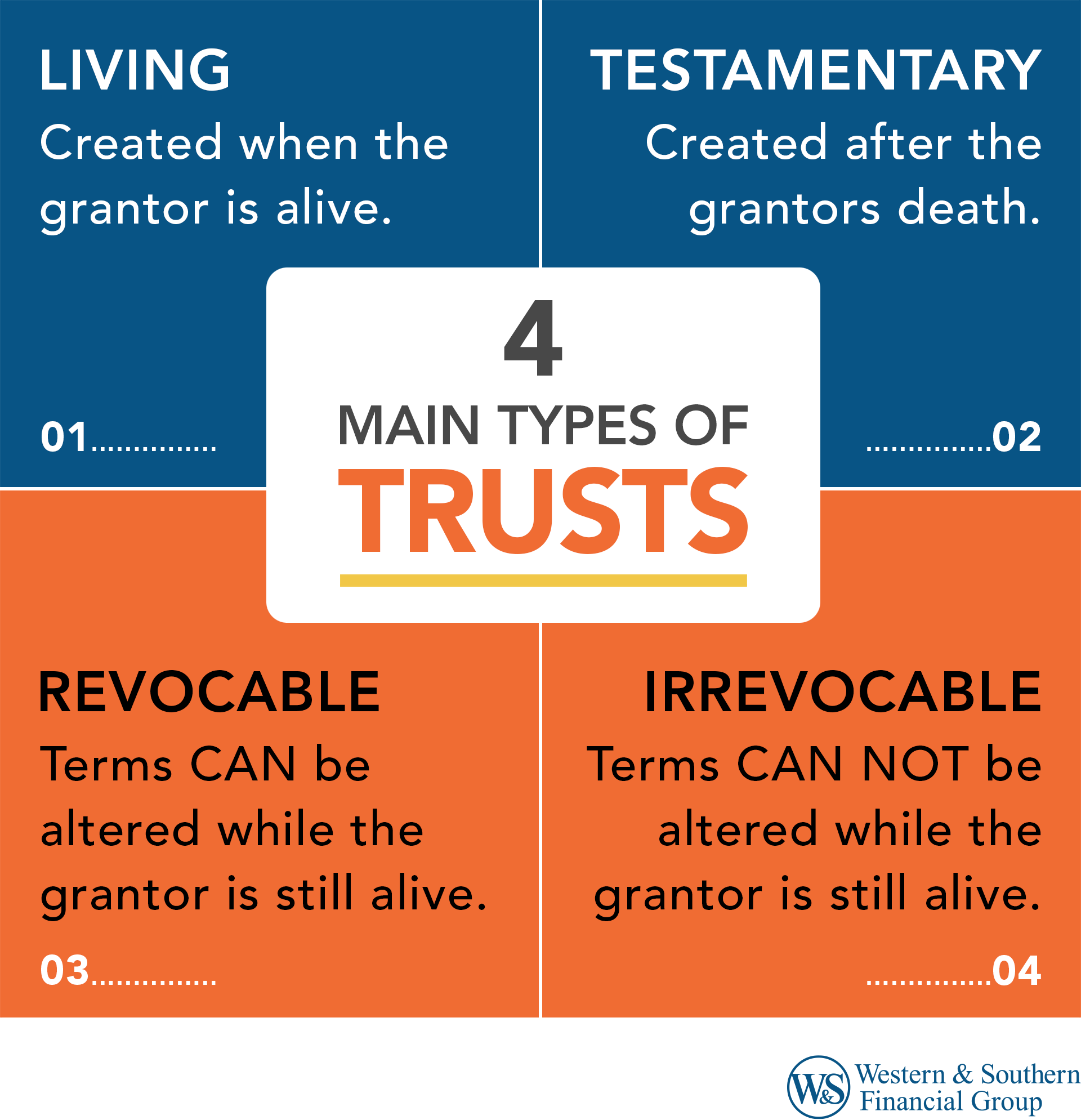

Additionally, developing a count on can supply a safe way to shield your possessions for future generations. Trusts can assist you control just how your assets are dispersed, reduce inheritance tax, and safeguard your wide range from lenders. By applying these methods and looking for expert suggestions, you can protect your properties efficiently and safeguard your financial future.

Long-Term Possession Protection

To make sure the long-term safety and security of your wide range against prospective threats and uncertainties gradually, strategic planning for long-lasting property protection is necessary. Lasting asset security entails implementing steps to secure your properties from various risks such as financial declines, lawsuits, or unforeseen life occasions. One critical aspect of long-term possession security is developing a trust fund, which can offer significant advantages in protecting your possessions from lenders and lawful disagreements. By moving possession of properties to a trust, you can protect them from potential risks while still keeping some level of control over their administration and distribution.Furthermore, diversifying your financial investment profile is one more essential strategy for lasting property security. By spreading your investments throughout various asset classes, sectors, and geographical regions, you can reduce go to website the influence of market fluctuations on your overall riches. Additionally, frequently examining and updating your estate plan is important to guarantee that your possessions are secured according to your wishes check over here in the long run. By taking an aggressive technique to long-lasting property protection, you can guard your wealth and offer financial security for on your own and future generations.

Conclusion

In conclusion, count on foundations play a vital duty in guarding properties and ensuring financial security. Expert guidance in establishing and managing trust structures is important for long-term asset protection.Report this wiki page